Bagley Risk Management : Protecting Your Service Future

Bagley Risk Management : Protecting Your Service Future

Blog Article

Comprehending Livestock Risk Protection (LRP) Insurance: A Comprehensive Guide

Navigating the realm of animals risk security (LRP) insurance coverage can be an intricate venture for several in the agricultural industry. This type of insurance offers a safety internet versus market changes and unpredicted circumstances that might impact animals manufacturers. By comprehending the ins and outs of LRP insurance, producers can make informed choices that may guard their operations from financial threats. From exactly how LRP insurance coverage operates to the various protection alternatives readily available, there is much to reveal in this comprehensive guide that could potentially form the way livestock producers come close to danger monitoring in their services.

Exactly How LRP Insurance Policy Functions

Occasionally, comprehending the technicians of Livestock Danger Defense (LRP) insurance can be complicated, yet damaging down just how it works can supply clarity for farmers and ranchers. LRP insurance policy is a risk monitoring device designed to shield livestock producers versus unforeseen rate declines. It's important to note that LRP insurance policy is not a profits warranty; rather, it concentrates only on price danger defense.

Eligibility and Insurance Coverage Options

When it comes to protection options, LRP insurance offers producers the adaptability to pick the protection degree, coverage period, and recommendations that finest match their threat monitoring demands. By comprehending the eligibility requirements and coverage choices available, livestock producers can make enlightened decisions to take care of risk properly.

Benefits And Drawbacks of LRP Insurance Policy

When reviewing Animals Risk Protection (LRP) insurance policy, it is vital for animals producers to weigh the benefits and disadvantages fundamental in this threat monitoring tool.

One of the primary advantages of LRP insurance policy is its capability to provide security versus a decline in animals costs. Furthermore, LRP insurance policy supplies a level of flexibility, permitting manufacturers to personalize coverage levels and plan periods to suit their details requirements.

One constraint of LRP insurance coverage is that it does not secure versus all types of dangers, such as condition outbreaks or all-natural calamities. It is important for manufacturers to carefully analyze their individual risk direct exposure and economic situation to establish if LRP insurance policy is the best danger management device for their procedure.

Comprehending LRP Insurance Coverage Premiums

Tips for Maximizing LRP Benefits

Optimizing the advantages of Livestock Danger Protection (LRP) insurance calls for calculated planning and aggressive danger management - Bagley Risk Management. To make the most of your LRP insurance coverage, take into consideration the complying with ideas:

Frequently Evaluate Market Conditions: Stay informed concerning market fads and rate variations in the look at this site livestock sector. By keeping an eye on these aspects, you can make enlightened decisions regarding when to purchase LRP insurance coverage to safeguard versus potential losses.

Set Realistic Coverage Levels: When choosing insurance coverage levels, consider your manufacturing expenses, market value of livestock, and potential threats - Bagley Risk Management. Setting practical protection degrees ensures that you are appropriately protected without paying too much for unnecessary insurance

Expand Your Protection: Rather than counting only on LRP insurance policy, think about expanding your danger management methods. Integrating LRP with various other risk monitoring devices such as futures agreements or choices can provide thorough protection this link versus market unpredictabilities.

Evaluation and Adjust Coverage Consistently: As market conditions alter, regularly evaluate your LRP coverage to ensure it lines up with your existing risk exposure. Readjusting coverage degrees and timing of acquisitions can aid enhance your danger defense technique. By adhering to these tips, you can optimize the advantages of LRP insurance coverage and protect your livestock procedure versus unpredicted risks.

Verdict

In conclusion, livestock threat defense (LRP) insurance coverage is a beneficial device for farmers to take care of the economic dangers related to their animals operations. By understanding just how LRP functions, eligibility and protection choices, in addition to the benefits and drawbacks of this insurance, farmers can make enlightened choices to safeguard their incomes. By thoroughly taking into consideration LRP costs and executing methods to optimize advantages, farmers can reduce possible losses and ensure the sustainability of their operations.

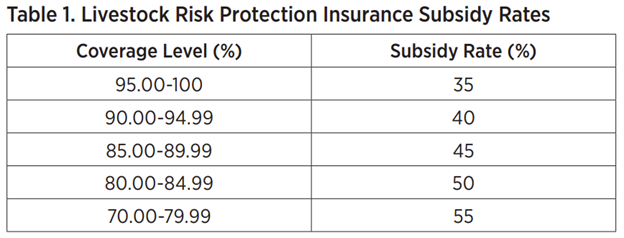

Livestock manufacturers interested in getting Animals Threat Protection (LRP) insurance coverage can explore an array of eligibility criteria and protection alternatives Get More Info tailored to their specific livestock operations.When it comes to protection options, LRP insurance offers manufacturers the adaptability to choose the coverage degree, coverage period, and endorsements that ideal fit their threat monitoring needs.To grasp the intricacies of Livestock Danger Defense (LRP) insurance coverage completely, comprehending the variables affecting LRP insurance coverage costs is vital. LRP insurance coverage costs are identified by various components, consisting of the coverage degree picked, the anticipated cost of animals at the end of the protection duration, the kind of animals being insured, and the size of the protection period.Testimonial and Adjust Coverage Consistently: As market problems alter, regularly assess your LRP protection to guarantee it lines up with your existing threat direct exposure.

Report this page